Web2 & Web3, sitting in a tree.... (you know the rest)

A summary of the on-going Web2 vs Web3 debate

Shots were fired, battle lines were drawn, and the feud between titans of Web2 and Web 3 reached all new heights. If you dabble on the front lines of tech/crypto Twitter, you were likely caught in a violent crossfire of opinions and hyperbole about the future of the internet. Comment and interject at your own risk. For the streets are strewn with victims of violence and mania!

Okay, I'm being a bit dramatic… The violence was at a minimum and the debates have been refreshingly civil. While most crypto feuds mirror a shouting match from The Jersey Shore (religious zealotry and emotional bias abound), this recent conflict has felt more like a proper Oxford Hall debate.

Both sides delivered cogent, practical, and level-headed insights. As an innocent bystander, I was hanging on every word for the course of the past month; jumping into all the Twitter spaces, scanning all the threads, reading all the fall out hit pieces. It was quite the doozy. To my surprise, it also created a new sense of internal tension. I've been a hardcore proponent of Web3 for years (as my friends/family/colleagues will woefully lament). But I found myself nodding in agreement with both sides, flip flopping my stance as both Web2 and Web3 threw their respective jabs and counters. Where was my conviction? Are the money-making aspects of crypto clouding my judgement? Is Web3 really a better version of the internet? One that actually protects the rights and property of the individual? Or is it just an overtly complex and inefficient digital casino for 'degens'?

This has evolved into quite the polarizing topic. There are very smart and respectable people on both sides of the debate, and very few seem to fall in the middle of the spectrum. You've either been completely red pilled, viewing Web3/crypto as a catalyst for a revolution and the next creative renaissance; one that will lead to the greatest transfer of wealth and power in human history. Or conversely, you view Web3 as a complete scam; full of speculation, irrational architectures, and inefficient resources. Nothing more than ponzi schemes all the way down, with no practical real world use cases. That's quite the range! Such derision and polarity are usually reserved for conflicts of the political, religious, or cultural variety. Less so for tech and business model innovation.

But I guess that's the thing... Web3 is indeed a political, cultural, and religious movement. For many, Sathoshi Nakamoto is a modern-day Jesus, Ethereum's ecosystem is a sci-fi Woodstock, and Bitcoin is the digital Boston Tea Party.

So how to make sense of all this? How to find nuggets of truth amidst all the noise? As astute practitioners of 'Medium Energy' ;-), we know the power of paradox and the importance of holding conflicting ideas in our mind, knowing both can be simultaneously true.

Eager to crystalize my own thinking and reaffirm my stance, I thought it'd be useful to lay the core criticisms out on the table and try to succinctly summarize each. Okay I might have failed at the ‘succinct’ part (shocker), and this essay gets a bit technical at times. But it’s designed to help you learn and sharpen your technical chops. And while this list is not exhaustive, it reflects where the conversation has turned, where the big questions lie, and where challenges with Web3 do indeed exist. We're not going to dive deep too deep into the technical complexities on both sides of the debate, but I'll provide links to articles that do so far better than I ever could. Reading them has been quite enlightening. I suggest you invest the time and do the same.

Okay, on to our programming. We’ll start with the less technical arguments, and move towards the nitty/gritty stuff towards the end (at which point I’ve provided TLDR sections, offering a ‘choose your own adventure’ type experience for those seeking a lighter read).

Whichever adventure you choose, I hope this essay leaves you feeling a bit smarter and enlightened.

Web2 Argument: Web3 business models are overly reliant on speculation

This argument claims Web3 is overly reliant on tokens to incentivize early adopters. On one hand tokens are a breakthrough, allowing users to become owners. But Web2 folks are concerned with the risks in misaligned incentives for users depending on when they join the network. In other words, there is an inherent declining ROI for those who join the network over time. If the first 1,000 users get filthy rich, and the millionth user earns very little, human behavior indicates those late users will leave for a new network where more money can be made. There's also risk in those now wealthy early adopters leaving the network if/when token prices start to fall.

The Counter: Yes, human behavior/greed needs to be considered. But this is not a technical problem. It's a problem of system design that is certainly addressable. What’s needed are innovative incentive mechanisms for users across the various stages of adoption. This is starting to happen in the form of voluntary token lock ups (e.g vesting schedules), rewards for contribution, and rewards for longevity. But it's also important to understand the role of speculation in the early phases of any new technology. It's a feature, not a bug. It's a tool for installation (of early adopters). Without people speculating that this tech could be big, it wouldn't garner a price. Without a price you couldn’t treat the tokens as money. And without money, it'd be difficult to attract builders to allocate time/effort towards creating all these apps. In short, the Web3 economic model is a new bootstrapping mechanism. Eventually, certain networks will reach escape velocity and achieve powerful network effects, at which point the overall network utility will outweigh the potential economic upside. At this point the network/market will become self-sufficient and sustaining. The billionth user won't be coming for the money, but the actual service the network provides. Crypto has the opposite emergence mode of a social network. We’ve grown accustomed to DAU (daily active users) as the leading metric. We'd pile up users, and then figure out ways to make money off those users (which as we know, led to business models that turned users into data models to be feasted on by algorithms). Now, we're flipping the script. First we pile up the money, and then use those resources to attract users with utility, aligned incentives, and choice. Those users are coming as we speak, and they're soon to come in droves.

Web2 Argument: Venture capitalists own Web3 and retail investors are a bunch of suckers

This was a swipe thrown by Jack Dorsey, claiming retail investors are suckers in VCs master plan to own the internet, set up as exit liquidity for VCs who got early access to tokens like Solana, Polkadot, and Avalanche. VCs bought these tokens in the $.01 - $1.00 range, and have earned out-of-this-world returns. Solana is officially one of the best angel/VC investments of all time, returning 1,838x in less than three years to seed investors. Wild... Dorsey also seems to suggest that VC ownership erodes the ideals of decentralization and that VCs have more power in the future of these networks than we think. This position is common amongst 'BTC maxis'; people who think Bitcoin is the one and only true crypto currency with any meaningful future. Consider Jack Dorsey one of their ring leaders.

Counter: Of all the jabs thrown against Web3, I think this one is the biggest head scratcher. For a whole slew of reasons... First, Jack created the meme above and used Ethereum as the example. This is the worst example of all, and flat out wrong. Almost zero VCs jumped into the ETH ICO (initial coin offering). 95%+ of ‘seed stage’ investors were early developers and high-conviction retail. Projects like Solana, Avalanche, and Algorand do skew more in this direction. But even then, it’s not like VCs had some sort of evil plot to take control of the internet (despite the rhetoric). They played the game in front of them; capitalizing on an opportunity, taking risk, and intelligently allocating funds. That's what they exist to do: fuel innovation when no one else will. VCs own a chunk of Web3 tokens because they bet with accuracy. Tough to fault them for that, much less the builders they support. Sure, Paradigm owns a bunch of Uniswap (UNI), and Multichain has a ton of Solana (SOL), but guess what... huge swaths of retail investors went along for much of the ride too, creating a wealth generation effect unlike anything we've seen in modern society. Money was quite literally falling out of the sky. This was not possible in the Web 1 or Web 2 era, in which outsized returns were completely limited to VCs and the in-crowd who got it pre-IPO, leaving retailers to pick up the (relative) scraps on the public market.

Not to mention, there are extreme differences in Web2 equity investing vs. Web3 token investing. Web2 is about buying passive equity in a company that provides a fiat denominated return base upon profit maximization. When retailers buy Web3 tokens, they're buying active ownership (and often times participation) of a protocol, with a non-fiat denominated return that can be compounded by innovations like staking, token governance, airdrop for participation (see Uni airdrop), etc. Apples and oranges.

It's also important to rethink the definitions and roles of network participants/token holders. At maturity, 'capital allocators' and network participants will be considered one in the same, with VCs operating as a standard stakeholder alongside everyone else; contributing to token economics and incentive design, ideating on future products or use cases, participating in active governance discussions, and helping with project evangelism. With VC ownership comes a fear of too much VC control. But control is entirely dependent on the VC and the particular investment structure that is used. If properly designed, the wider community controls the direction of the project. Not VCs. Sure, a VC can post a governance proposal, but so can a college student in Brazil. Both proposals will be vetted by the community and valued on merit, and the line between a capital allocator and a community member will be blurred.

People also label this VC ownership as a source of 'centralization'. They fail to realize that early stages of centralized ownership are often designed with intention. It's just too difficult to build something from scratch in a fully decentralized manner. It's becoming common practice in Web3 to start centralized, and then move towards a more decentralized network overtime (see Jesse Walden's Progressive Decentralization: A playbook for building crypto applications). This is proving the best way for new things to get built; projects start off relatively centralized to gain momentum and find early product market fit, and then over time, begin distributing ownership and control to the community. Even the most decentralized asset, Bitcoin started off quite centralized in the the hands of a powerful few.

Lastly, a quick point on the US regulatory environment. Concentrated VC ownership is very much a product of out-dated regulation. Ever since the 2017 ICO boom (initial coin offering), Web3 teams have been pressured to fundraise from AML/KYC investors willing to jump through legal hoops. From a regulatory perspective, it's far less risky for a project to raise from 'accredited investors'. Until we see regulation reform, VC will always have the first bite of the apple. The current regulation is old code that doesn't work for the current operating system. If there's to be one downfall in the US remaining the center of economic power, it's going to be over regulation or reliance on old regulation. We're far past orange tree groves as a blue print for what is/isn't a security (aka: 'the Howey Test'). It's time to think from first principles, within the context of a digital first era.

Okay, now on to the technical portion. Strap on your focus cap, because we’re about to get into the weeds. But fret not….If you’re feeling lazy, I’ve provided a TLDR blurb for each dense section.

Web2 argument: Decentralization is a crock, consumers don't care, and centralization is inevitable.

TLDR: This position claims the average consumer doesn't care about decentralization. It also posits that most of the successful 'Web3' services providers are actually quite centralized (as is the flow of data), consisting of mostly Web2 type architectures.

What we are seeing is something very similar to the transition from Web1 to Web2, in which power accrues to a few winners, as does centralization... because centralization works. The critics like to balk at the slew of fancy words and concepts preached by Web3: decentralization, peer-to-peer protocols, permissionless, immutable, open, etc. All neat aspects of public blockchains, indeed. But as anyone from the Web1.0 era will tell you; these are not net new innovations. We've seen parts of this movie before via protocols like SMTP (email), TCP (internet packet transmission), and HTTP (web). All open, decentralized, and permissionless in their own right, powered by peer-to-peer back-end architectures. And as far as 'owning' your content... nothing is stopping creators today from spinning up a server, hosting their content, and owning the data/audience end-to-end. In which case, 'permissionless' publishing was the whole point. Web1 very much had the same spirit and intention as Web3, but what we learned is that individuals, even tech savvy developers, don't want to mess with running their own servers and back-end systems.

Skeptics point to Coinbase and Opensea as the go-to examples at the front end of the tech stack, and Alchemy and Infura on the back end. When using front-end services like Coinbase and OpenSea, most of the data is stored on AWS/Azure servers, and very little data is actually stored on-chain. This is simply because it is too expensive, cumbersome, and slow to store all this data on-chain today. For example, NFTs today are just a string of numbers (aka: a certificate of authenticity, or an 'autograph') on-chain, with a URL pointing to the media file, often stored in a S3 bucket (AWS storage service).

As for the back-end... when you use a 'dApp' or crypto wallet, you're rarely interacting with the blockchain directly. The vast majority of API calls and data flows through companies that rent out infrastructure; Alchemy and Infura. These companies abstract away the complexity running your own servers and blockchain nodes. Sound familiar? It's practically the same paradigm we have today in Web2 with public cloud providers such as AWS.

Web3 Counter: (1) Traditional client-server architectures are coming, (2) data lives off-chain today due to block space constraints (that are being addressed), and (3) decentralization is the wrong hill to die on. The real innovation is permissionless access and control of our 'user data' (in contrast to permissionless control of published ‘content')

Blockspace

TLDR: Data is being hosted off-chain due to a lack of blockspace. But innovation to open up more blockspace is on the horizon. This is akin to when internet providers (e.g. Netflix) were constrained by internet bandwidth, and forced to compromise (e.g. send DVDs in the mail)

The current critique of Web3 data not being decentralized is fair. Most NFT content/media files are hosted in a centralized place (aka: data stored 'off-chain), where they technically can be altered or corrupted, regardless of who owns the NFT certificate itself (aka: on-chain data). But it's shortsighted to say that Web3 is doomed as a result. This critique fails to take into account the notion of 'blockspace' and how its usage/availability is going to evolve. If blockchains are strings of blocks that store information, think of blockspace as the amount of remaining space within any one given block. The size of blocks varies from blockchain to blockchain, which impacts its performance (e.g. latency, throughput). This was a topic of heated controversy and historical importance within the Bitcoin community (e.g. this book called the The Blocksize Wars) If you want a primer on the concept, read this.

Some data is stored off-chain because it’s simply too expensive and slow to do so today. There just isn't enough blockspace. Demand is severely outpacing supply, which is why Ethereum gas fees are so high (a classic champagne problem really... as this proves product/market fit). Lack of blockspace is indeed a technical restraint, for now... Just like bandwidth was a major constraint for Web1 and Web2.

Balaji Srinivasan breaks this down beautifully in this tweet, using Netflix as an analogy. Netflix always knew that streaming was the future, but internet bandwidth to do so at the time was limited. So, they resorted to mailing DVDs. Eventually, bandwidth and internet speeds increased dramatically, and streaming became a reality. Similarly, the lack of available blockspace has led many Web3 companies to resort to less-than-ideal forms of centralization. However, they know decentralization is the future, and that innovation to address blockspace is coming. Ethereum is completely transforming to support a full ecosystem of Layer 2 solutions that will host data and process transactions. At which point, the Ethereum layer-1 chain will just be a settlement layer validating the integrity of Layer 2 activity. We're also seeing a rise in additional Layer 1 chains like Solana, NEAR, Fantom, and Avalanche with their own solutions to these problems. Perhaps most importantly is the advent of Web3 storage solutions such as ARWeave, designed solely for storing Web3 data in a decentralized and chain-agnostic way.

In short, with blockspace innovation comes more on-chain possibilities.

Client-Server Architectures

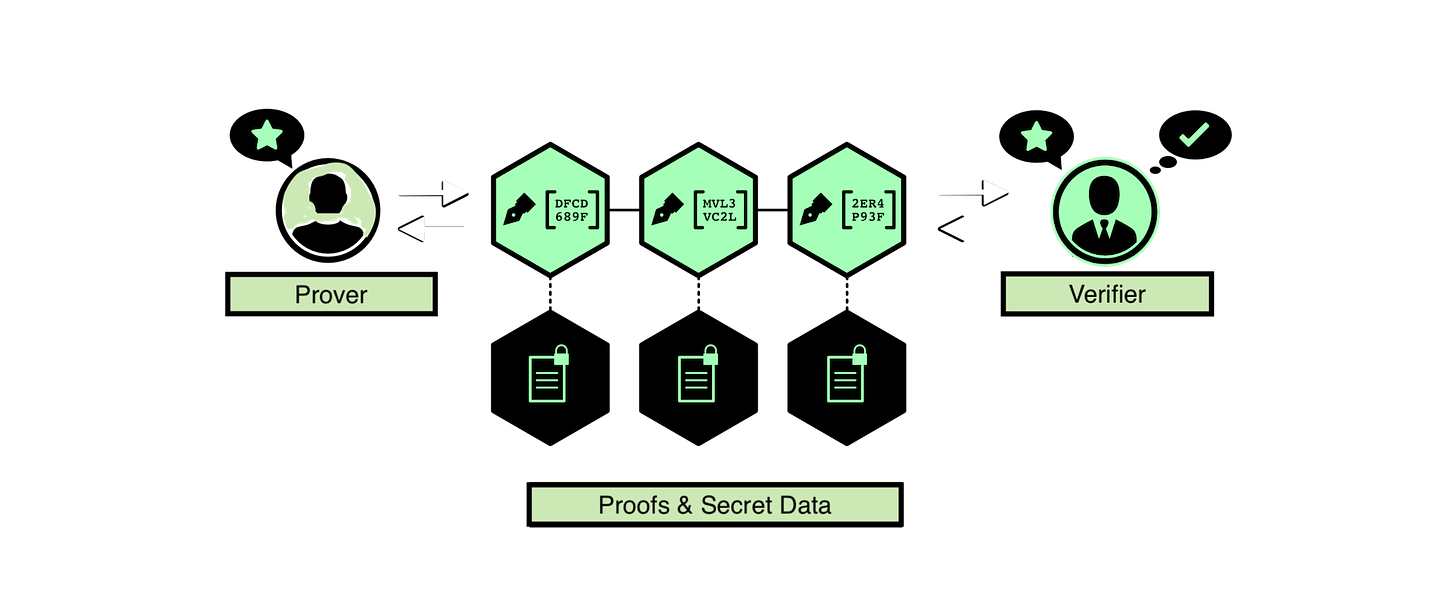

TLDR: The traditional client-server relationship doesn't yet exist with blockchains, prohibiting mobile devices from fully participating in Web3 networks. And without some sort of interface between servers/blockchains and clients, developers are dependent on middlemen such as Infura/Alchemy to run servers/node, and forced trust them to deliver the right information. So much for cryptography enabling trustlessness... BUT, cryptographic tech like light-clients and Zero Knowledge Proofs is on the way, allowing mobile clients to look/feel like full blockchain nodes, participate in the network, and erode away the middleman.

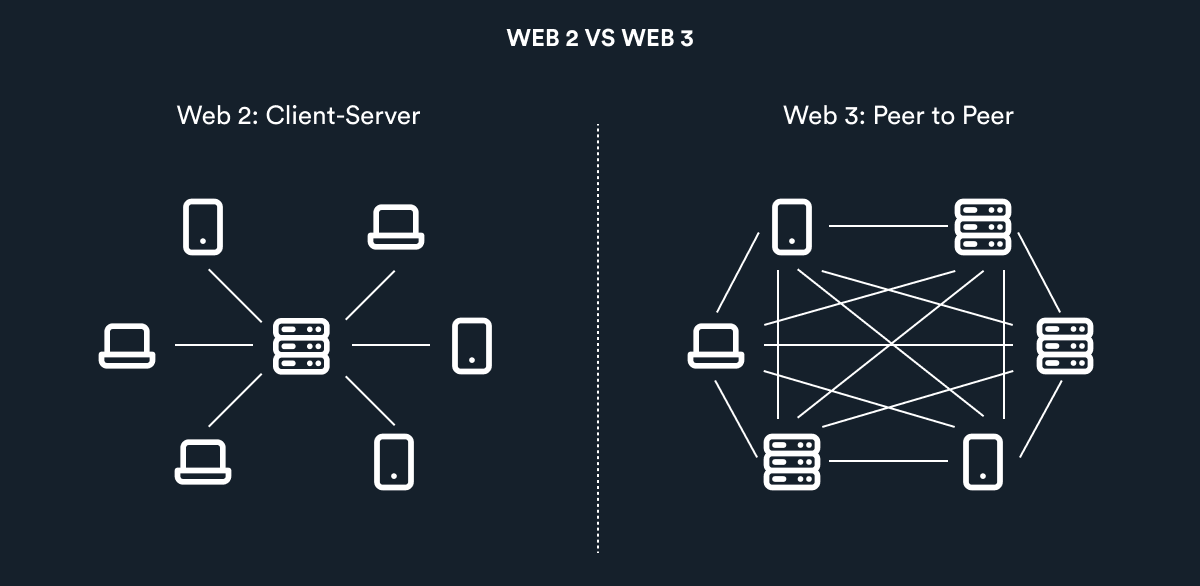

To understand this argument, it's helpful to have a very basic understanding of web architectures. This isn't the most tantalizing topic, but bear with me as I over simplify. In the Web1 era, the internet consisted largely of peer-to-peer networks, with a bunch similar machines all in communication. The notion of a client and a server didn't really exist, the machines were all considered equals (aka: peers), and they were all (in a sense) acting as both server & client.

That changed with Web2. Suddenly you had a bunch of (what we now consider to be true) 'clients' (lighter weight devices/apps) connecting to one gigantic centralized box/hub that hosted most of the data and did most of the processing. The architecture looked like N number of clients connecting to 1 master server hosting a closed and private database (e.g. all your data closed off in a Facebook/Google owned/operated box).

In Web3, the back-end vision can be simplified to down N clients connecting to K 'servers' hosting an open and public database, i.e. numerous open back ends connecting to numerous front ends.

However, this is not exactly how things work in Web3 today.

Why? Because of the way blockchain networks are designed. Effectively, they leave the traditional notion of a 'client' (your mobile phone) out to dry. In web2 terms, a client is hardware/software that connects to a master sever. The blockchain world uses the terms 'client' and 'servers' a bit more loosely, to the point of not being very useful.

Like Web1, they are practically synonomous, yet again. In the blockchain context, a client is just a server with software that connects to other clients (other servers running the same software) in a peer-to-peer manner. All these ‘clients’ talk to each other, forming a network in which each client/server is often called a 'node'. Historically, there's only been one type of node; a 'full node', which is responsible for downloading the entire blockchain, and in turn, validating and sending every transaction and every block on the network..

And herein lies the problem... traditional client devices (your phone) can't operate as 'nodes' and run the blockchain software. They aren't powerful enough. As a result, the traditional client-server relationship doesn't exist. If you want to interact with the blockchain directly, you have to run your own server, which people simply don't want to do (too much overhead). And without some sort of interface between servers/blockchains and clients, developers are dependent on middlemen such as Infura/Alchemy to run that server/node, forcing developers to cross their fingers and trust them to deliver the right information. So much for cryptography enabling trustlessness...

Okay, so we've learned that mobile devices/smart phones can't fully participate in this new ecosystem. And considering we live in a mobile first world, it's hard to imagine a pure Web3 future in which mobile devices are not properly integrated into the network. So is Web3 doomed to the same fate as Web2? A bunch of centralized middlemen renting servers and routing our data? Not quite... This critique of today's paradigm is also fair, and yes, it has led to some centralization. But critics often prove ignorant to the fact that two technologies are being developed to address: 'light clients' and 'zero knowledge proofs'.

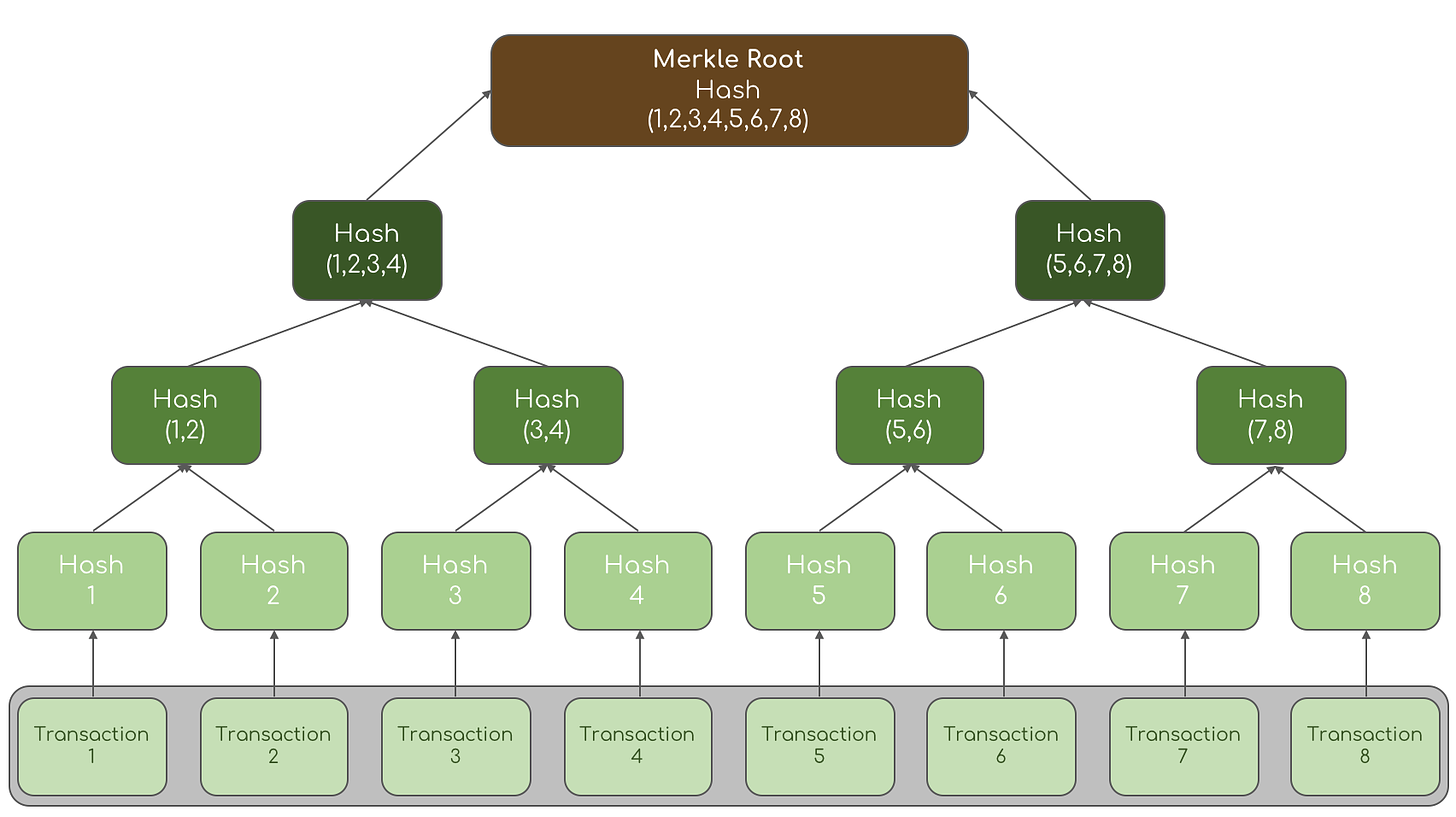

Light Clients: Simply stated, light clients will help end-users access and interact with a blockchain in a secure and decentralized manner, without having to sync the full blockchain software, and without reliance on an Alchemy/Infura. The breakthrough with light clients revolves around something called a 'merkle tree root'. Think of this like a fingerprint of all the information on the blockchain. When a light client requests information from a 'full node', it confirms its validity by ensuring the fingerprint matches up with the corresponding block. This allows mobile devices to partially participate the network, requiring far less storage. The what and the how is too technical and dry for this forum, but if you want to get a high level overview, check out this tweet form Vitalk Buterin (founder of Ethereum) for a deeper dive.

The key word here is 'partially'. Light clients are in a sense.... ‘selfish’. They only take the information they need to run an app, and avoid the value-add work of verifying the state of the blockchain network and paying fees. This is a problem because it leads to risk in the network becoming centralized over time. If client devices can't fully participate in the functions of the network, we risk a bunch of powerful institutions controlling all the full nodes, and everyone else (folks like you and me) becoming second class citizens in the ecosystem. What we want is a world in which light clients can participate as first-class citizens i.e. a peer to full nodes; serving and relaying information while rewarding a full node with fees upon tapping into its resources.

Doing so requires a way for mobile devices to look/feel just like full nodes. They need the ability to verify its accuracy without downloading any of the blockchains software/database. This path lies with technology called Zero Knowledge Proofs, and Ethereum researchers are making exciting progress on this as we speak.

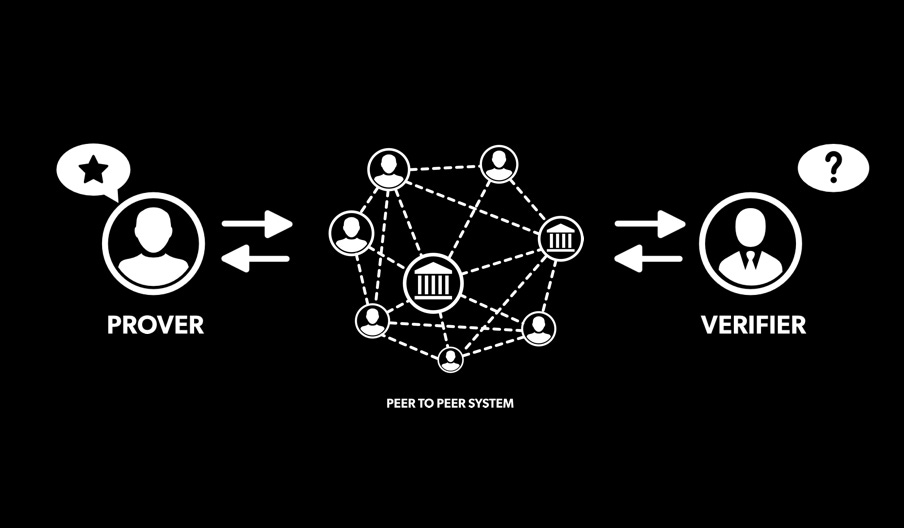

Zero Knowledge Proofs: This technology is the key to a fully trustless system, and over time, a trustless society. One in which truth and access to information is validated by math, not passwords that can be stolen, or institutions that can be breached.

In a sentence, ZK Proofs allow you to validate the truth about something (say, your identity, or your ability to pay rent), without having to reveal the actual details or source of said truth. For identity today, we have to show our government issued passport or Social Security #. To confirm our finances, we have to show a bank statement or a credit score. With ZK Proofs (ZKPs), you don't have to reveal any of this sensitive information. Rather, algorithms will process an associated type of data from the 'provider', and then give the 'verifier' a simple 'true' or 'false'. The big takeaway is this: in the case of our light client example, ZKPs will allow full nodes to verify the integrity of the blockchain data to light clients/mobile devices, without revealing the blockchain data itself. If it sounds like magic, it's because it kind of is. ZK Proofs are worth an entire essay to themselves and a fun rabbit hole to jump down. The implications are profound, and once you grasp them, you'll walk around and see use cases everywhere throughout your daily life. And if you're feeling up for a deep dive, check out this essay from Packy McCormack, or this shorter piece from 'Towards Data Science'.

I know all of this architecture talks is boring. My eyes lids got heavy just writing it. But it’s important to understand because of the impact they have on economic models and user behavior. We all know the economic outcome of Web2. With the advent of the 'master server/private database', a decentralized network of servers and open protocols evolved into a handful of extremely powerful and centralized entities.

Now, some could argue this wasn't a function of a private database, but rather a function of 'power laws', in which economic power always concentrates. We're seeing early signs of this in Web3 with Web2-like companies being built on top (e.g. Coinbase, OpenSea). And that very well may be the case again in Web3. But even if that is the final result, these new open back-ends completely shift the way value is created, the way money flows, and how incentives are aligned. In turn, the ensuing behavior of organizations and their participants changes dramatically. Let's visit this in the 'Permissionless' section below.

Permissionless

TLDR: Decentralization isn’t the breakthrough. It’s about permissionless access to data enabled by consensus mechanisms like proof-of-work. Similar to the Web1 era, this gives the users CHOICE, lowering their switching costs and limiting Web3 service provider power/control e.g. lowering their take rates (hence OpenSeas 2.5% fee on transactions vs. FB/Twitter/Instagram taking 100% of revenue, YouTube taking 45%, and Apple’s app store taking 30%). Critics shouldn’t be asking ‘are there centralized services in Web3?’. Yes, there always will be. The right question is, “are there centralized services with high switching costs?”. The answer is no.

A common gripe from technical Web2 folks is that a mySQL database is perfectly sufficient for most use cases, and decentralized databases are inefficient. They also like to point out that we already had decentralized protocols via Web1, and look where we ended up. Decentralized protocols make things harder to use and slower to innovate. Hence why centralized services like G-Mail thrive on top of decentralized protocols like SMTP.

Comparing Web3 protocols to Web1 protocols is the wrong mental model. They are very different beasts. Web 3 protocols are 'stateful' vs. 'stateless'. SMPT and HTTP simply transport data, they don't store data (aka: 'state'). Blockchains are the first protocols to actually hold data/state, and be 'stateful', hence the database component. This in mind, decentralized protocols are not the breakthrough to be excited about. The breakthrough is permissionless access to this new type of database. This wasn't achievable until Bitcoin. Prior to Satoshi's magic with the consensus mechanism Proof of Work, we had no way of maintaining consensus amongst participants (this is one of the key technical breakthroughs worth studying. See this, and this). In other words, the ability for anyone to both contribute to and agree on what is in that database, allowing for data control and portability.

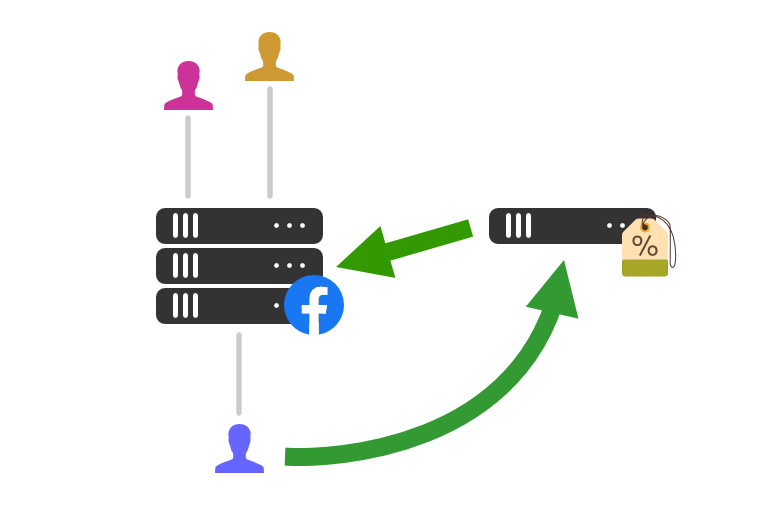

Balaji Srinivasan wrote an article that breaks down this problem in detail (Yes, You May Need a Blockchain). He discusses how in the current paradigm, only a single entity controls the database. And from the perspective of the cloud services/architectures, there's only one economic actor in this system; whoever is paying the cloud/data center bill. As a result, there's only one 'account' with full access (that company and its employees, e.g. Facebook, Twitter, Google). But in reality, these systems have hundreds of thousands of economic actors...

Shouldn't we consider back-end systems through the lens of all the other participants in the system? Balaji lays out some questions that help shine light on the problem.

"Can these actors interoperate? Can their users pull their data out and bring it into other applications? And given that the users are themselves economic actors, if this data represents something of monetary value, can the users be confident that their data wasn’t modified during all this exporting and importing?"

The technical answers to these questions are nuanced, but the simple answer is no. Reason being, there are simply no incentives for these 'private database providers' to enable their users to export/import of data, much less their competitors. As a result, despite users/economic actors within Twitter, Facebook, and YouTube creating much of the value, they have no recourse when these entities change the rules.

Chris Dixon lays out this argument well in this tweet thread. To summarize, users/creators don't have choice or optionality in response to the misbehavior of Web2 providers, e.g. charging too much, inserting ads and algorithmic garbage, throttling their traffic, or mistreating in other ways. Practically speaking, creators/users can’t just up and leave. They spend years upon years building an audience and a portfolio of content that is locked within that platform. As a result, switching costs are just too high. These barriers didn't exist within Web1. If I was hosting my own website with a web hosting provider, I could easily move my data to another host and switch my DNS records to have the domain name point there. I could do all this without losing my audience. Web3 hearkens to the values of Web1. Similarly, there will be popular, centralized services that arise on Web3. But their economic power and overall control will be limited by the lower switching costs thanks to data portability.

This problem is particularly acute with web properties who rely on ad-based business models. Unfortunately, this is the vast majority of the internet today, and it has led to what Jon Stokes calls the 'adversarial web'. One that relies on intense data collection to analyze you, identify you, and experiment on you in order to modify your behavior. In doing so, its sole intent is to shape the user into a biddable consumer in the form of a data graph. As Stokes says, "this system doesn't care if you become a white supremacist or a BLM activist, as long as you're hitting certain engagements and behavioral metrics."

Stokes goes on to summarize the core problem of Web2 better than I ever could, recapping his experience in educating his daughter on Web2 vs. Web3.

"The intelligent, adaptive machinery of the ad-driven, adversarial web doesn't know about positive concepts like excellence, virtue, civic duty, truth, health, or beauty, nor does it recognize negative ones like vice, strife, indolence, ugliness, decay, or lies. It functions in an entirely different universe of abstractions (engagement, conversion, time on site, net promoter score, reach, viral coefficient, etc.) that's just totally unrelated to most of the things we're trying to teach her at her age. Web2 pursues its own agenda on its own terms, and what happens to the spiritual and physical health of her and her generation is largely irrelevant to it. It simply does not care because it wasn't even designed to."

This didn't happen because Web2 entrepreneurs and leaders are soul sucking demons. Per Stokes, it happened due to a misalignment of incentives, rooted in how money flows through the system. Jon's article is a must read, and a great way to understand how this money flows today vs. in Web3 (Web3: The Rise of the Aligned Web).

In closing….

There’s a slew of other arguments against Web 3: Web3 innovation is slow, data portability isn't interesting (because data requires context within specific apps), deciding what data should live on-chain or off will be hard, and Web3 is too dependent on complex human coordination.

Sure, it will be challenging to be decide what data goes on-chain or off-chain. And yeah, human coordination has always been hard. But should we stop innovating and experimenting because it's hard? There's plenty of innovation happening around communicating off-chain data to blockchains, for example Chainlink 2.0 (creating effectively 'APIs' to real world/off-chain data). And yes, there will be plenty of data that isn't relevant for portability. But there is a core set of data that will be... Predominantly data about who we are, what we like, who we know, the audiences we've built, where we live, the assets we own, etc. The list goes on. All of this data can be used in creative/strategic ways to provide a better, more personal, and more autonomous user experience. As for the slow piece, I look around and only see an explosion of innovation and new projects moving at the speed of light. If you turn off twitter or podcasts for a week, it feels like you've missed out on months of progress.

Overall, I think Web3 critics often have the wrong mental models, and with an overly skeuomorphic lens. But I also think Web3 advocates over index on a purely Web3 future. The reality is that the future of the interet is going to be happy blending of the two, with Web2 architecture supporting and delivering certain types of data, Web3 securing and validating other types of on-chain data, and everyone living happily ever after.

Aditya Agarawal sums these feelings well with this tweet, stating:

"I find this commentary somewhat naive in that it ignores how technology ends up weaving it's way through the next generation of products. Most stuff isn't going to be more clean in one world than the other. It will be messy. Things will feel like cross ideological boundaries. The idea that the future is here, but is unevenly distributed captures part of this. More likely, the future will be intermingled with the past for a long time. This is basically the same conversation we have seen with autonomy, AI, SaaS, etc. The world is too complex to try to predict in any form. Instead, I tend to think about whether the underlying ideas are useful and can be used. In that sense, blockchains, NFTs, DAOs, Defi, etc. are all super interesting constructs that will be used to create interesting things. Don't focus on trying to predict. It's much more interesting to build."

To some, the Web3 vision might sound as crazy or non-practical as Kennedy’s vision to land a man on the moon. But we tried, and we did. Such ambition and hope rallied great minds and talent behind a single arrow. Incredible technological progress emerged as a result. So, how about we don’t shy away from challenges. How about we don’t try to predict the future based upon a primitive past. How about we just continue to experiment, learn, and build; one line of code, one block, and one governance proposal at a time.