Fix the Money, Fix the... World? | Part I

An exploration of fiat f*ckery and why you should care

"There are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, "Morning, boys, how's the water?" And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, 'What the hell is water?'"- David Foster Wallace

How often do you think about money?

Probably more than you care to admit.

How often do you think about how money works? Its source, its governance, its very nature...

If you're like most people, probably very little.

Most of us are the two little fish from above, myself included. But after researching the past, present, and future state of money, I promise you... becoming the older fish has become consequential, if not existential.

Some stats that ripped me down the money rabbit hole.

Globally, nearly half of the world’s countries experience double digit inflation. (Hidden Cost of Money)

If inflation hovers at just 10% over the next decade, and wages can’t keep pace, people will need almost 3x the amount of money to buy the same goods and services in ten years.

Hint: wages are not keeping pace e.g. see US, see Cali, and see Japan (suggest watching). And as we’ll discuss in this essay, the US is far from immune from a similar fate.

For those that point to CPI coming down… (the ‘Consumer Price Index’ how we measure inflation), CPI is a complete scam. It doesn’t measure the things most people actually desire, and it replaces goods with cheaper versions as they inflate (moronic, I know)… hence why people aren’t feeling a difference, even though they say inflation is falling. This all ties to…

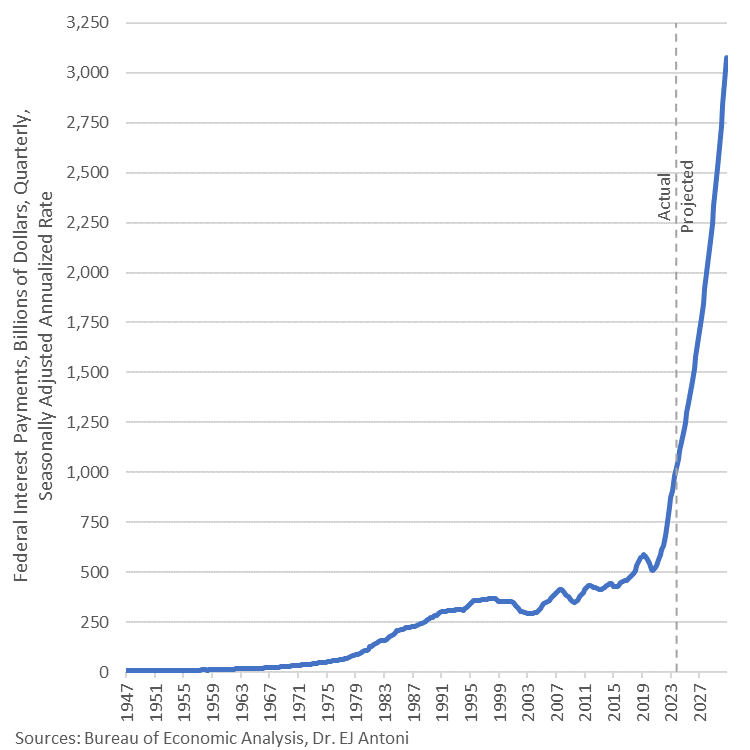

In the US, 80% of your personal income taxes are going towards not just government debt, but the INTEREST expense on that debt. Soon, all of our taxes could go towards just interest… it’s predicted to hit $3T by 2030… TOTAL US revenue (aka all income from all taxes today is just over $4T). Check this chart….

Meanwhile… The US Government is currently on track to produce over $6T in debt, annualized. It took the US 225 years to accumulate $6 trillion in debt. We're now going to produce $6T within 1 year.

That's $12 million, every minute, of every day, i.e. $12M more worth of 'energy' than we actually produce. Every 60 seconds.

The Treasury is now predicting an annualized interest expense on that debt of $1T. In November 2023 alone, US debt interest was $89B. This is more than we spend for the Departments of... Agriculture, Education, Energy, Transportation, Homeland Security, Justice, State, Transportation, NASA, and Veterans Affairs... combined

The worst part? Interest rates have sky rocketed, causing the costs on this debt to more than double as it rolls over... not to mention the higher costs on all the new debt that is accelerating. Aka: a debt spiral (must read tweet from James Lavish).

Our go-to solution to this problem? Inflation: a shadow tax extracting purchasing power from our savings and pushing the debt burden on to the public. How & why?

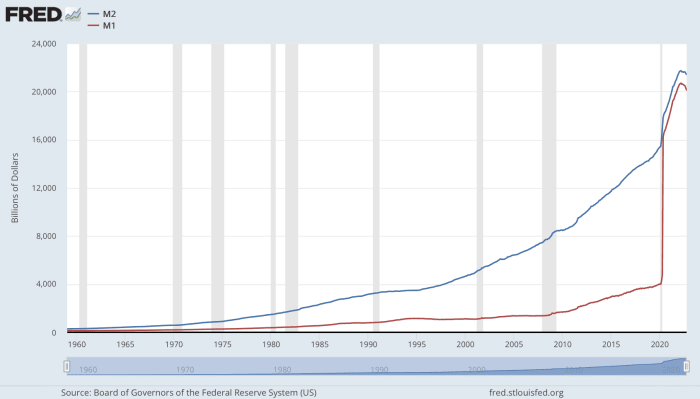

Between 2008 - 2023, the US Money Supply has increased by 246%, aka more than 2x the amount of US dollars have been printed in the last decade than in the history of the US dollar.

The net result? A reverse robinhood effect, moving purchasing power from the have nots to the haves

Between 1975 and 2018 in the US, $50T has moved from the bottom 90% to the Top 1% (Hidden Cost of Money)

While bureaucrats are getting wildly wealthy (Nancy Pelosi, with a $400k salary, obtaining a net worth over $170M. Elizabeth Warren, with a similar salary, and who came into government with very little net worth, now worth over $60M.)

All of these bullets fit into the same puzzle. And this is just the tip of the iceberg that is modern day money.

This essay series is my attempt stitch them all together and uncover a potential solution.

Here in Part I, we’ll start to reveal water by exploring the obvious problem. In Part II, we’ll expose the indirect, less obvious problem and all of its downstream effects.

Lastly, in Part III we’ll discuss how we got here, how we can protect ourselves as individuals, and how can start getting things back on track.

Part I | The Water

Ah, money $$… one helluva perplexing puzzle, indeed.

On one hand, money is one of life's most vital forces, acting as a powerful and ubiquitous form of communication & expression (i.e. money talks).

It signals our values & beliefs, spurs our missions & plans, and allows us to do what makes us most human: coordinate, invent, and transcend.

On the other, it can also be one of the most damaging; it's the world's #1 source of stress, the #2 cause of divorce, and as the faithful like to quote from the bible, "the root of all evil".

But actually... that's not quite right.

People tend to forget the full quote, "for the love of money is the root of all evil".

Money must be treated as a tool. The wisest amongst us know this intuitively and the richest amongst us have learned it the hard way: money can't solve all our problems, it rarely buys us happiness, and it can't give us purpose.

But it can give us the freedom to cultivate these things from within.

Not just for the individual, but our community, our countries, and our species writ large. It's ability to do so relies on being a 1-to-1 proxy (or storage mechanism) for our most valuable & scarce resource: our energy and our time.

Sadly, this is far from the case. In reality, our money is horribly broken.

For starters, consider one of money's (many) formal definitions: the final extinguisher of debt.

Yet the money we rely on today is made up entirely of debt. How the hell can debt be the final extinguisher of debt?

It can't.

As a result, money is being engineered to work against us, robbing us of that most valuable & scarce resource (energy + time).

Or, consider the notion of the Federal Reserve (our central bank controlling it all).

For starters, it's not 'federal' (its a privately owned institution with mysterious shareholders) and it holds absolutely zero reserves (there's not a single reserve backing our money, just an endless black hole of IOUs/debt, which is now spinning wildly out of control).

Or how about the fact that the Federal Reserve was founded in complete secrecy.

It was done so under the guise of a 'hunting trip', by a handful of the richest & most powerful bankers & politicians in the world. With fake names and fake alibi's, they gathered on an island off the coast of Georgia to concoct the ultimate enterprise: one with zero down side and pure profit, all at the expense of the US public, and eventually… the entire world. (if curious, check out this alarming exposé about the Fed: The Creature of Jekyll Island)

Its sponsorship was then co-opted via sneaky, behind the scenes propaganda with the leaders of our countries most powerful academic institutions.

While fiat money has been broken for the entirety of its 50+ year experiment (since inception post 1971 Nixon Shock), the ruse is up. The cracks are blasting open and its failure is now self-evident.

As this essay series will explain, our monetary system has become one of the most upstream aspects of societies greatest challenges: a widening wealth gap, looming automation + AI, climate change, political polarity, social unrest, mental health, education, home ownership, and outright survival in a world of rapidly rising prices for... well just about everything.

The reasons why are complex and nuanced, layered across a winding history (gold, wars, geopolitics) and rooted in technical path dependency (double entry accounting, the telegraph for transactions, slow settlements speeds).

It’s a problem space also chock full of nonsensical jargon and bewildering system design; clear as mud and impossible for the average person to grasp; to the point of seeming purposefully designed to conceal.

Now, this topic is often avoided. I think out of fear of being considered a pessimist or a conspiracy theorist.

But let's consider the perspectives of some of our most intelligent economic actors.

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."- Henry Ford

Or how about the guy who created the very economic theory behind this whole charade...

"By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some....As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery." - John Maynard Keynes

Let that one sink in... this the father of Keynesian Economics: the very 'modern' economic theory that drives inflation and that we teach empathically in school...

Another fun one.

"In the long run... paper money... must either collapse in hyperinflation or force the government to adopt a policy of increasing control, and eventually total control, over all economic resources. Both scenarios entail economic disruptions on a scale that we can barely imagine today" - Jorg Guido Hulsmann, The Ethics of Money Production.

Hmmm... and here we are, considering a Central Bank Digital Currency: limitless surveillance & control.

Okay, I think I've made my point and hopefully have your attention. But fret not. As bleak as the problems below will seem, human ingenuity hasn't let us down to date.

Here in the waning moments of the 4th quarter (or in reality, over time...), we've drawn up a play to hit a buzzer beater for the ages.

Indeed, humanity's immune system is identifying and responding to the ruse, carving a path that just might save the day. And it's all thanks to our favorite topic here at Medium Energy: technology.

But not just any technology, a technology owned by no one, accessible to all, and not invented, but rather... almost like fire... discovered, at the perfect time and in the most poetic fashion.

With that, let’s carve out some time, harness some focus, and put on our thinking caps. It's time to see water and seek truth.

The Obvious Problem

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” – President Thomas Jefferson

Sorry, couldn't help myself with one more quote... Because in an eerie fashion, President Jefferson nailed it. We ignored his warning and found ourselves in a system designed to steal our savings (i.e. our property) via inflation.

Whether its intentional or not is irrelevant. The incentives of the system are warped and the end result is theft, in its most obfuscated form.

We can debate how/why we got here until we're blue in the face. But it’s hard to argue against the thing that underpins it all: a malleable and centralized base ledger for money that is constantly being manipulated (aka a 'soft money').

The direct problem with soft, manipulated money is becoming obvious: a loss of purchasing power from a growing money supply.

No, not just growing. Exploding.

Between 2008- 2022 the Fed has partnered with big banks to print $10T, increasing the US Money supply by 246%.

More than 2x the amount of US dollars have been printed in the last decade than in the history of the US dollar. About $5T of this was printed in just the last few years (If new to this topic, see this link: the what & how of money supply)

The other top currencies have followed suit (EUR, YEN, etc) and now the entire developed world is the proverbial frog, and central banks are the witch over the cauldron, boiling away its people's hard-earned savings, slowly... but surely.

This has been going on for decades, but now, something is starting to feel wrong. You can feel it in daily life and the game is starting to feel... rigged.

If you feel this way, you're not crazy. One of the primary reasons is a broken monetary system, reliant on 12 fallible humans in an opaque, ivory tower, making arbitrary decisions about how much money should be in the system (aka money printing, or, 'quantitative easing'), and how much capital should cost (aka interest rates).

As a result, for the first time in history, most American's can say they are not better off than their parent’s generation.

Some facts to drive the point home (from Seb Bunney's fantastic book: "The Hidden Cost of Money")

Wages are not keeping up: Since 1971, while minimum wage has risen in numerical dollar terms, its actual purchasing power adjusted for inflation has dropped to that of around the 1950s. We're seeing a similar effect impacting the middle class (see here, here, and here).

Owning a house is becoming a pipe dream: Home prices have sky rocketed, especially relative to wages. In 1970, the ratio of average home prices to the average wage was 4:1 (homes cost 4x the average income). Today, that ratio is 8:1. And in the most desirable locations: top cities, coast lines, etc. Its much worse, ranging between 50:1 to 100:1. This is most acutely felt by millennials, for whom home ownership is starting to feel like a pipe dream. In 1990, when baby boomers were at a median age of 35, they were able to own 33% of US real estate. Today, for millennials, that number is 4%...

Stock prices are detached from reality: To continue the generational comparison... in 1970 it took the average person 28 hours of work to buy a single share of the S&P 500 Index (based upon average wages). Today, it takes 125 hours.

Food is becoming a heavy expense- If it feels like grocery shopping is putting a greater dent in the wallet, that's because it is. Food inflation is around 11% in the EU and 8% in the US.

Energy prices have hockey sticked- Prices for heat/electricity in many places across Europe have more than doubled over the last few years

Amidst the developing world, and outside the top 5-10 currencies, these problems are far worse and more blatant...

There are over 160 fiat currencies in the world today. The vast majority of them are rapidly losing value, if not already eviscerated. Almost half of all countries (81) experience double digit inflation. Egypt's currency was cut in half in 2016 (relative to USD), Turkey reached 85% year over year inflation in 2022, and Argentina reached over 100% in 2023. That's just the short list...

Being conservative, if inflation hovers at just 10% over the next decade, they'll lose 65% of their purchasing power. Meaning... if wages don’t keep pace, people will need almost 3x the amount of money to buy the same goods and services in ten years (hint: wages are NOT keeping up. And at the current rate, the US could easily be in the same boat... which we'll explore later).

Most of us have heard these anecdotes. But they fade into the background. They're distant and foreign and we tend to think we're immune. It could never happen here. Right?

If you're reading this, you likely live in a developed country, with a good enough currency and good enough payment rails. Through this lens, its easy to be in 'everything is fine' mode.

With relative ease, you can park your money in a bank, transfer it around, push it into various assets (stocks, real estate, gold), and become an active participant in the global economy. As a result, you at least have a shot at pacing inflation and riding the 'everything bubble' (if you have enough money to invest, of course...).

If this is you, congrats. You won the cosmic lottery.

But consider one more flip of the coin.

You'd likely have been born into the other half of the world that lives not only with rampant inflation, but also under shades of authoritarian regime with nonexistent or corrupt banking systems. You'd be trapped into a currency with little to no global acceptance, near zero liquidity, and no digital payment rails to move/transfer if you wanted to leave.

In these places… some facts from Lyn Alden's (no exaggeration) absolute must-read book, 'Broken Money':

A young man in Sudan was publicly hanged for using an alternate currency.

People in Ethiopia use salt to store their 'savings', and they're jailed for using the USD.

The poor in Argentina either use clay bricks, or spend their money before it inflates.

People in Egypt park their money in empty homes.

Banks in Lebanon are freezing accounts, forcing young women to resort bank robbery to support their families.

The list of these horror stories goes on and on: Brazil, Israel, Mexico, Vietnam, Poland, Venezuela, Bulgaria, Ukraine, and even developed countries like Japan (again, watch this).

Humanity has come a long way over the last century. Yet, place of birth remains the key variable in the opportunity for a better life, with economic upside.

Perhaps they’d benefit from a globally accepted, debasement resistant, unseizable, permissionless savings tool, one that could help people bring or send their money/property anywhere in the world… while also plugging them into the prosperity engine that is the global economy + the internet.

One of the most alarming aspects about inflation: it’s surprisingly under-examined and under-discussed.

Sure, it appears in headlines and people acknowledge the number. They also take action to control it while Wall Street convinces us to play a game of investing/paper shuffling to outrun it.

But there’s very little public discourse about why it exists, what purpose it actually serves, and what the 2nd/3rd order effects really are.

Rather… we're led to believe it’s normal; something that the government can control for the benefit of the economy. Some even believe it’s a natural phenomenon.

It's not. It's just a policy, rooted in Keynesian Economics and riddled with flaws and nonsense (see again, above quote from good ol’ Johnny Keynes himself).

We explore how & why in Part II, while also laying out why, sadly… this whole charade is not going to stop any time soon.