This is Part II in our series exploring one of the most upstream problems of our time: a broken monetary system.

In Part I, we focused on the obvious problem: money printing & inflation (aka fiat f*ckery).

For complete context & appreciation, suggest reading Part I first (link here).

But I get it, time is money... so here's the Part I TLDR:

Modern day money (aka fiat currency) is horribly broken. Why? Because time is money, indeed. And we are being robbed of it, slowly but surely, one (trillion) printed dollar(s) at a time.

Money is a storage mechanism for all the effort, energy, and sacrifices we've made in the past, i.e. our savings. As we turn towards the future, these savings allow us to design, plan, and create the life we want. Sadly, most people around the world struggle to live the life they want (having kids, owning a house, good education, high quality food, a vacation or two, etc). Inflation is a major reason why and it’s poised to only get worse...

In turn, inflation has become one of the most critical problems of our time. Money is upstream of everything... and when you follow the trail, you'll see that its manipulation is a major factor in many of humanity's greatest challenges: the wealth gap, popularism & political polarity, AI & automation, mental health, climate change, war, the list goes on.

The heart of this problem is a ledger of money that is soft, manipulated, and easily corrupted. With a few strokes of a key, the supply of money has sky rocketed, causing a loss of purchasing power and an erosion of our savings/time.

In just the US, between 2008- 2022 the Fed has partnered with big banks to print $10T, increasing the US Money supply by 246%. More than 2x the amount of US dollars have been printed in the last decade than in the history of the US dollar. In other countries, this problem is far worse and much more blatant (see Japan, Brazil, Israel, Mexico, Vietnam, Poland, Venezuela, Bulgaria, Ukraine)

Globally, nearly half of the world’s countries experience double digit inflation, largely driven by similar increases in money supply. (Hidden Cost of Money) If inflation hovers at just 10% over the next decade, and wages don't keep pace, people will need almost 3x the amount of money to buy the same goods and services in ten years. The stark reality is that wages are not keeping pace e.g. see US, see Cali, and see Japan (suggest watching). And as this essay explores, the US & developed world are not immune from a similar fate...

With that backdrop, let's dive into Part II, where we'll hit two topics: (1) Inflation's common misconceptions, and (2) the less obvious problem it creates.

“If anyone can refute me—show me I’m making a mistake or looking at things from the wrong perspective—I’ll gladly change. It’s the truth I’m after, and the truth never harmed anyone. What harms us is to persist in self-deceit and ignorance.” -Marcus Aurelius

Don't we need inflation?

Despite its impact, inflation is surprisingly under-examined and under-discussed.

Sure, it's in the headlines and people acknowledge a number. We also take actions to control it while Wall Street encourages us to outrun it; spurring us on with their favorite investing + paper shuffling games.

But there’s very little public discourse about its true purpose and its 2nd/3rd order effects.

In contrast, we're led to believe inflation is normal; something that the government can control for the benefit of the economy. Some even believe it’s a natural phenomenon.

It's not. It's just a policy, rooted in Keynesian Economics and riddled with flaws and nonsense.

For starters, let's look at CPI (Consumer Price Index): the 'basket of goods' we use to measure & act on inflation. It's a complete scam. CPI doesn't include any of the things the average person actually desires, e.g. a house, a trip, the gym, a meal at a nice restaurant, etc.

It's also a moving target. They constantly change what's measured to hide the truth. At one moment, it will include the price of premium, Grade A beef. But once this beef becomes too expensive for the average consumer (i.e. a change in 'consumer preference'), it's replaced with low-grade beef. I mean... pure lunacy.

As for the idea behind inflation: they say we need it to spur consumption. Rather than save our money, we must spend it and get it moving through the economy to drive growth.

But when you get to the root of human behavior and incentives, you'll see the exact opposite is true.

In economic reality, we have to produce before we can consume. To produce, savings are required for meaningful & sound investment (e.g. not gambling on Game Stop, Dogecoin, or buying your 8th streaming service). Sound investment is what underpins entrepreneurship and money flowing to useful goods & services. It's this entrepreneurship that creates the true tail winds for growth.

If you come across someone stuck on inflation being necessary to spur investment & growth, you can challenge the idea in two ways.

First, just point to what historically became money on the free market: gold, the most inflation resistant commodity at the time. You can then point to the 1800s (when gold & silver were money). During this period, there was virtually no structural inflation.

This was a time of rapid innovation and massive productivity/growth, across the entire world. It was the time of rail roads, automobiles, electrification, and the harnessing of new types of energy. This was all upon a bedrock of harder money, one that people cherished and hoarded, sure, but deployed intentionally and strategically.

Second, consider the natural arrow of technology and progress. As just one example of many, the cost for a gigabyte of storage has dropped a thousand-fold. That value doesn’t just deflate away.

Rather, we’re able to use a thousand times more gigabytes. And with cheapness comes abundance, allowing us to consume more of the things we deem valuable.

So, when someone argues that an overly sound/hard money would hinder investment, they're double counting the idea, i.e. the argument negates itself.

That 'hoarded' unit of account only appreciates if technology is getting better over time. In other words, if technology & society are not advancing, and we remained stuck in the existing world, things aren’t getting cheaper and that unit of account is not buying us more stuff

But that's not how the world works. We are advancing and the invisible hand of technology propels us ever forward, constantly driving down price by lowering the marginal cost of production. But this progress only occurs due to investment.

So in theory, the only reason that unit of account would increases in value, and in turn, become worth saving/hoarding, is because investment would indeed be happening in the first place.

But this is not just theory. It's visible throughout history. Not just in the era of 1800's innovation & growth, but also during perhaps our most prolific era of human flourishing: The Renaissance (which was also on a sound money standard).

Now, this idea... this is what really prompted my study of money.

It's the idea of ‘reality distortion’, via a system that fights against the natural order of things and restricts our ability to reap the fruits of technological progress.

Meaning, in a natural world, technology is always boosting productivity and lowering prices. Or, per Jeff Booth's now famous quip: "prices always fall to the marginal cost of production."

These productivity gains should be flowing to society in the form of lower prices, making a good life more accessible to more people.

Yet, despite prices trying their damndest to fall (due to technology), we live in a debt-based system that simply won't allow it. It forces inflation and prices to rise to keep the mountains of debt from imploding.

Life could/should be getting better & cheaper, and people should be able to work less. Instead, life for most remains stagnant, and for many, it gets worse, forcing them to work more just to keep up.

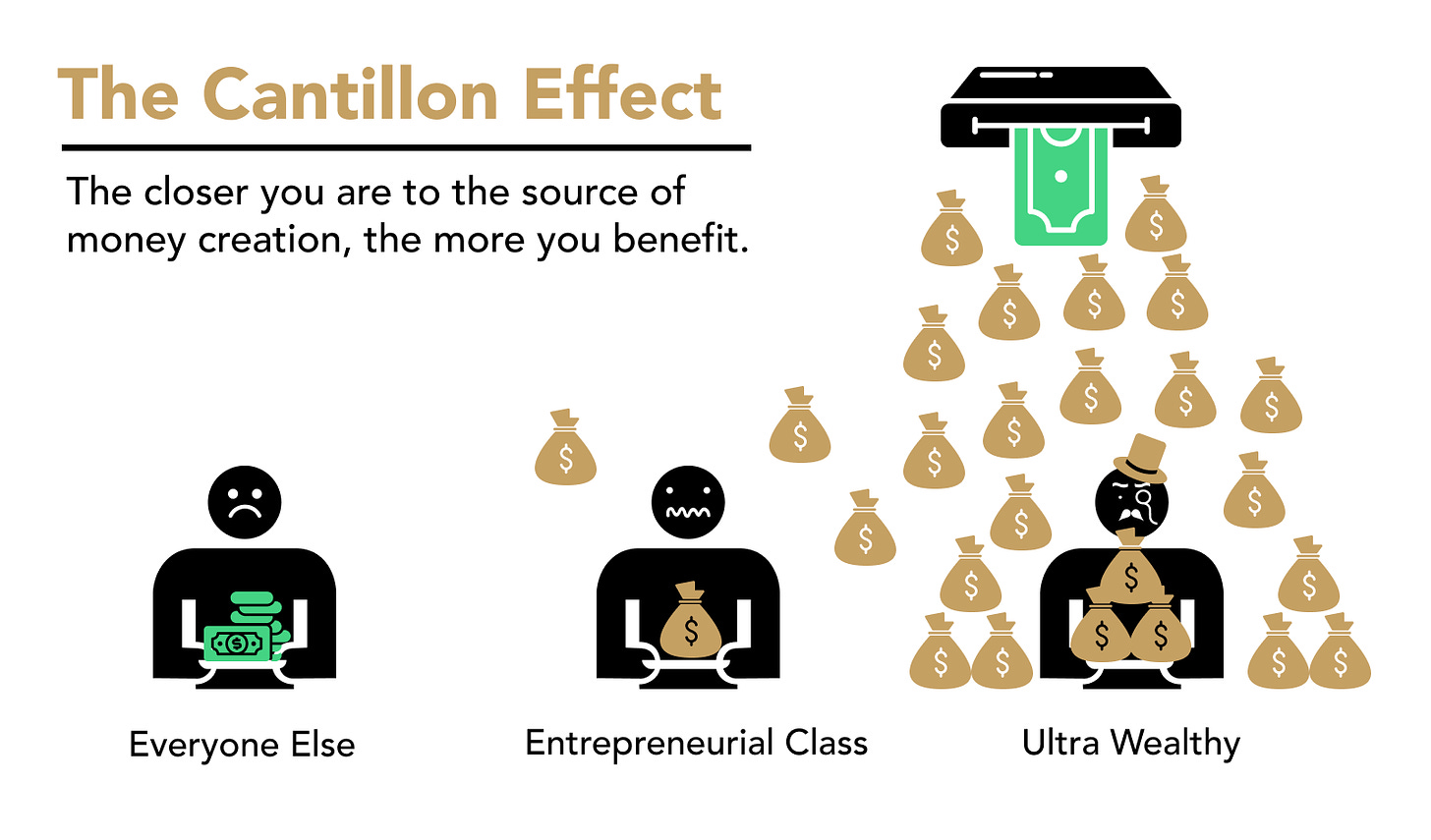

The worst part? Rather than productivity gains flowing into society, they get concentrated into the hands of the fortunate few: those closest to the source of money creation. Which brings us to the less obvious problem with inflation & money printing...

The Less Obvious Problem

On the surface, money is printed with good intentions. It's our systems favorite safety blanket and the quickest & easiest way to avoid short term pain (so are drugs and ice cream...)

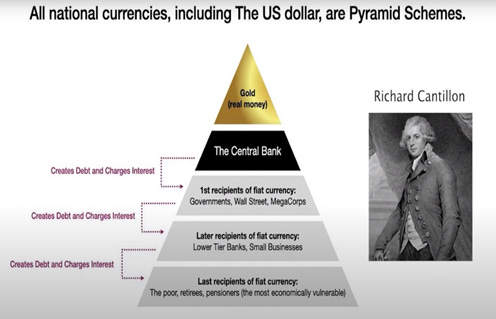

But behind the scenes, money printing is effectively two things: 1/ a mechanism for government to implicitly default on its debt, relying on inflation to push the debt burden onto the general public. And 2/ a reverse robin hood effect, moving wealth and purchasing power from the have nots to the haves.

These 'haves' include a host of beneficiaries who've parked themselves as close to the source of new money as possible, reaping massive benefits as a result. We're talking central bankers, politicians, big banks, wall street, monopolies, and anyone else the US government thinks deserves a bail out.

Why? Because they get access to freshly minted dollars first. They're able to use this money to acquire assets/capital before it enters into wider circulation and causes prices to rise.

As a result, the cost of the government defaulting on its debt is externalized onto society, and predominantly on to the middle & lower class. They don't own as many assets, so they don't get to ride the rising tail winds as things inflate. Asset prices rip upward, but their wages can't keep up. Hence, the widening wealth gap.

People seem to either avoid or ignore the topic. If you bring it up, people tend to suddenly see you adorned with a tin foil hat.

But consider the following quote from Part I of this series. This is from the very guy who created the economy theory behind economic intervention + inflation (Keynesian Economics):

"By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some....." - John Maynard Keynes

This is otherwise known as the Cantillon Effect, in which those closest to the source of money creation benefit at the expense of the rest.

Some call this a form of shadow taxation. Other calls it theft.

Theft sounds harsh, and perhaps bombastic. But what else do you call it?

No one voted for this. No one complied. No one was forewarned or educated about the whole charade.

It's like joining a startup and being granted shares. But little do you know, there's this (mysterious) group with the ability to issue themselves new shares on a whim, diluting your ownership stake in the process. Would you join that startup?

That's effectively our system. It dilutes our time/energy, our private property, and uses the proceeds to pay off government debt, all while helping the rich get richer.

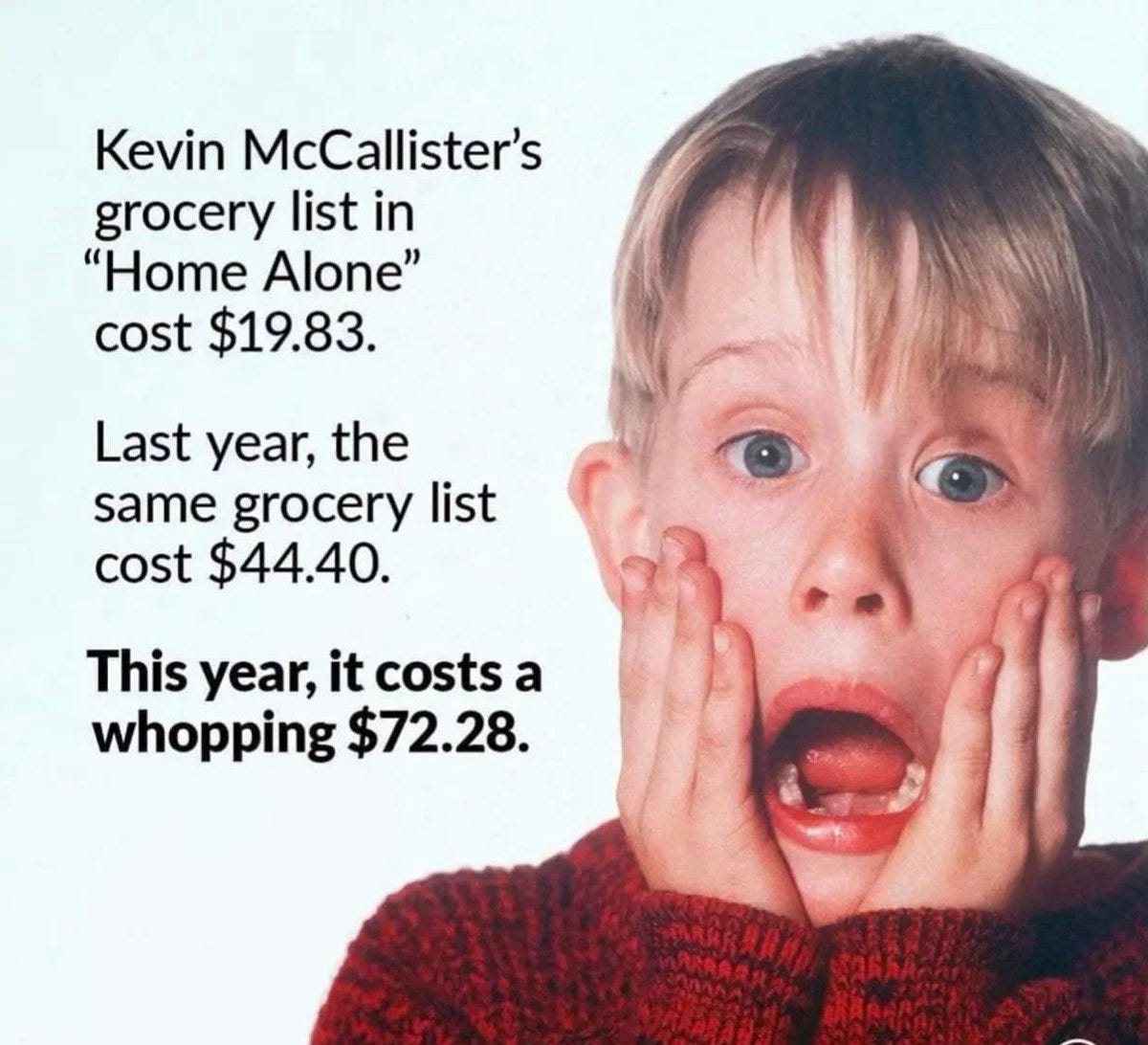

Meanwhile, for the average Joe/Jane, buying a house gets further out of reach, saving for a kids education is becoming futile, and basic groceries & gas blows up the budget.

Some macro evidence: between 1975 and 2018 in the US, $50T has moved from the bottom 90% to the Top 1%.

We're told that economic intervention and money printing is meant to help the lower/middle class. In reality, it does the opposite, creating all kinds of downstream problems. The most damaging is the effect on people’s sense of hope & purpose as they remain stuck on a treadmill, or worse, shot backwards into the wall.

Is this being done explicitly? By evil people twirling their mustaches with glee? Not necessarily. It's a result of the incentive structures in an inherently flawed system.

These incentives can longer be ignored. They cause theft to become the organizing principle of the economy. The result is a destruction of what should be an otherwise pure and noble game of human interaction; a game that should be positive sum, within a free market, in which we all deal with each other consensually, and every exchange has a bilateral benefit.

Rather, we're forced into a game in which the incentive is to print money and get as close to the stolen proceeds as possible, e.g. to own shares in the central bank (yes, this is a private, for profit institution), to become a bureaucrat, join a large bank, or work on Wall Street (where wages to push around paper are astronomically higher than anywhere else, ironically, all to help people race against the very inflation that they help create with central banks… coincidence?).

These people then go on to waste or gamble with 'customer money' (aka the citizens).

Government wastes it in too many ways to count, but to name a few: unnecessary warfare, mainstream media puppeteering, wokeism propaganda, geopolitical trade wars, and over (incompetent) regulation.

Hiding in the shadows of it all? Bureaucrats parked right next to, or worse, influencing the money spigot itself. Exhibit A: Nancy Pelosi, with a $400k salary, obtaining a net worth over $170M. Exhibit B: Elizabeth Warren, with a similar salary, and who came into government with very little net worth to speak of. She’s now worth over $60M.

This is akin to letting professional athletes gamble on the outcome of their own games.

As for the banks, Wall Street, and the monopolies they support? They enjoy privatized gains for a few years and distribute fat winnings to private shareholders. And then when they mess up and incur losses, government bails them out and pushes those losses onto the public.

It's worth noting the inherent incentive for inflation within the banking system that the Fed props up.

Many big banks operate with between 10x - 25x leverage. So for every $100 they use for loans, they only hold $4 - $10 of equity capital. The other $90 - $96 they use comes from your deposits. These banks need inflation, as it increases the value of the collateral backing those loans. That's the banking game in a nutshell; a debt-based house of cards that requires fiat currency expansion to increase the nominal value of the collateral on their debt.

Every other business model in the world is accountable to their solvency. But governments, banks, and Wall St? Not the case. They can drive up the prices of their own assets, and then socialize losses onto the rest of society.

Hence, the growing angst (everything feels expensive), social unrest ('Occupy Wall Street'), and populism (a lower/middle class in despair + Trump).

And hence, the common quip: "fiat is the real Ponzi"... A loop that feeds on itself; enriching those at the top, at the expense of those near the bottom.

Now, it’s not lost on me that I'm glossing over many details, and that this is a complex and nuanced problem. There's all kinds of tomfoolery sitting atop this system and no single institution, group, or individual is to blame.

But if there's one thing that can be blamed & targeted, it's a flawed incentive structure. At the heart of this incentive structure is a flexible, centralized, opaque ledger of money; nothing more than a single node, 1990's database managed on-premises at the Federal Reserve.

The energy/effort required for monetary expansion? The stroke of a few keys: alt-Control P.

Perhaps we should consider a ledger/database for money that is: 1) inflexible, decentralized, and transparent, 2) has a real-world physical constraint to producing more, and 3) is easy to self-custody and hyper portable.

With these properties, our savings could be protected, our money could work for us rather than against us, and the incentive structure would be flipped on its head.

Not only would this diminish the money printer as a form of shadow tax, and a mechanism for implicit default on its debt, but the state would also be held more accountable to its citizens; if the state erodes people's money and private property, the features of self-custody + portability would empower them to vote with their feet.

The worst part of this conundrum? All the debt they're trying to pay down with our purchasing power... its already insolvent. All of it. There is no realistic way of paying it off. The only solution is to increase the money supply and keep trying to inflate it away.

The multi-hundred-trillion-dollar question... how long can this go on? Forever? Is infinite leverage a thing?

Me thinks not… As the foundation wobbles, perhaps a parallel system is a good idea, and at the very least, a smart hedge or insurance policy.

We explore why in Part III...(see link here).

Hope you enjoyed, and if you found this enlightening, please subscribe and share with a friend or two :-)