This is Part III in our exploration of a broken monetary system, the accelerating debt spiral, and how human ingenuity + technology is poised to save the day, yet again.

In Part I, we focused on the obvious problem with our current system: money printing + inflation (aka fiat f*ckery).

In Part II, we hit the common misconceptions with inflation and expose the less obvious problem it creates (aka government stealing our time and The Cantillon Effect: the movement of purchasing power from the have nots to the haves).

To fully grok this essay, highly suggest starting with Part I & II. I think you'll enjoy... feedback on each has been quite positive.

But I get it, who has time to read?! In which case... here's a TLDR on Part I & II:

Modern money (aka fiat currency) is empirically broken. The root cause is a ledger for money that is entirely flexible, opaque, and easily corrupted, giving central banks and governments an easy button to fix short term economic pain. With the stroke of a key, they can print money & increase money supply on a whim.

In just the US, between 2008- 2022 the Fed has partnered with big banks to print $10T, increasing the US Money supply by 246%. More than 2x the amount of US dollars have been printed in the last decade than in the history of the US dollar. In other countries, this problem is far worse and much more blatant (see Japan, Brazil, Israel, Mexico, Vietnam, Poland, Venezuela, Bulgaria, Ukraine)

The result is rampant inflation. We're now told that inflation is coming down. But CPI (how we measure inflation) is a complete scam.. It doesn't include any of the things the average person really desires, e.g. a house, a trip, the gym, a meal at a nice restaurant, etc. They also replace key products/services within CPI with cheaper versions as the better version inflates... (!?!?!)

They also tell us we need inflation to spur investment & growth. Not true. See the booms in innovation & growth in the 1800s and during the Renaissance (both no a hard money standard, with no structural inflation).

In reality, the root incentive within our system is to boost money supply & create inflation. This is for three key reasons:

1/ Inflation is a mechanism for government to implicitly default on its debt and push the debt burden onto the general public (i.e. a shadow tax)

2/ Inflation moves wealth and purchasing power from the have nots to the haves. This is a reverse robin hood effect that is widening the wealth gap. The rich, powerful, and connected get access to printed money first, allowing them to buy scarce assets before prices rise downstream. Meanwhile, everyone else is priced out of living a normal, high quality life. They struggle to keep up, despair kicks in, and the seeds of popularism + social unrest are sowed...

3/ Inflation props up a system built upon mountains of debt. It needs inflation to boosts the collateral & value of loans, and to ensure centralized sources of power/control avoid default & complete collapse.

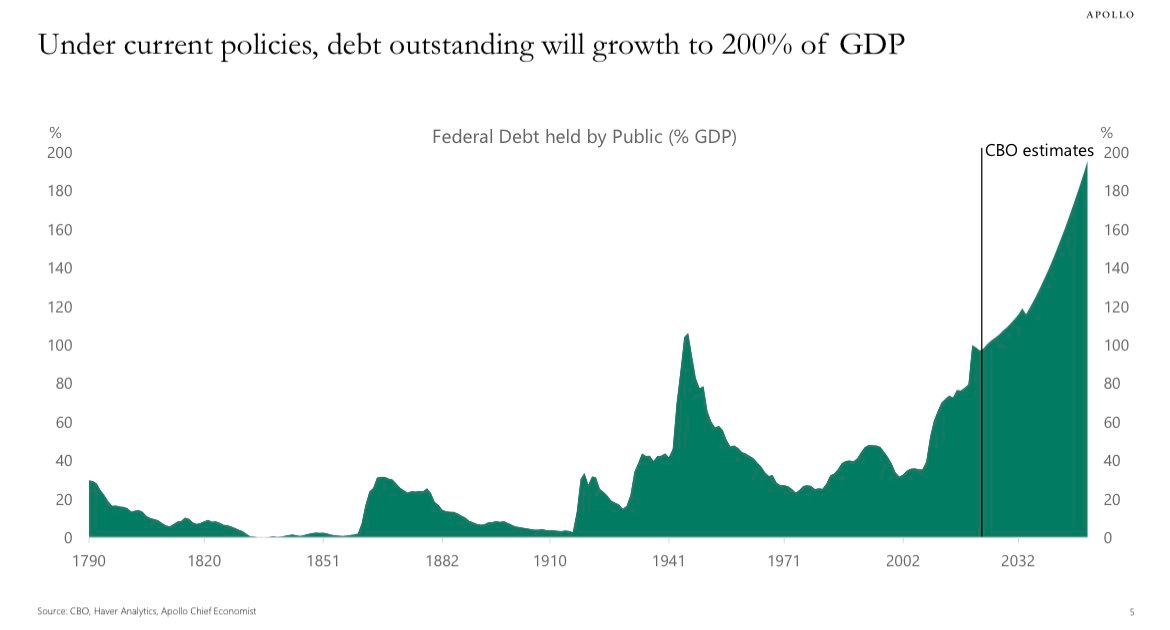

The stark reality of this situation: all the debt governments are trying to pay down with our purchasing power... its already insolvent. All of it. It's backed by nothing and there is no realistic way of paying it off. The only solution is to increase the money supply and keep trying to inflate it away.

The multi-hundred-trillion-dollar question... how long can this go on? Forever? Is infinite leverage a thing?

As the foundation wobbles, perhaps a parallel system is a good idea, and at the very least, a smart hedge or insurance policy.

Let's explore why.

Part III | Why Bitcoin (Really) Matters

Concerns about government debt are nothing new. We've all heard the hemming and hawing from parents, teachers, and politicians about government spending, the federal deficit, and austerity.

Real eye-glazing-change-the-channel-go-on-living-my-life type of stuff.

When I tried to explain our current debt crisis to a buddy, he said "Well yeah, what's new? America doesn't run on Dunkin', it runs on debt".

A cute Boston-native quip... Also a scary metaphor for general public sentiment, stemming from the fact that some people think they've seen this movie before.

The first debt hysteria happened in the late 80s/90s. That's when we created the famous 'debt clock' and Ross Perot had the most famous independent presidential run in history, campaigning on the federal debt issue and widening deficit.

Debt was indeed soaring and our interest expense was accelerating. People expected the sky to fall.

What they didn't expect was a 30 year period of unprecedented growth and deflation. China became our friend, the Soviet Union crumbled, and the eastern world opened up. This fateful marriage between Western capital and Eastern labor/resources birthed our savior: globalization.

In tandem, we dropped interest rates to historic lows and experienced a GDP bonanza. But the world and global banking system also became massively over leveraged along the way.

Decades of complacency later, our chickens are coming home to roost. It's the late 80s/90s all over again. But this time its far worse, at a much grander scale, and accelerating at a much faster pace: all by multiple orders of magnitude.

To explain why, let's start with the money in your wallet, or rather, the lack thereof (due to taxes). Peter St. Onge recently laid this whole fiasco out eloquenty in this video.

Highly suggest a watch/listen (about 3 mins long). Otherwise, I'll summarize:

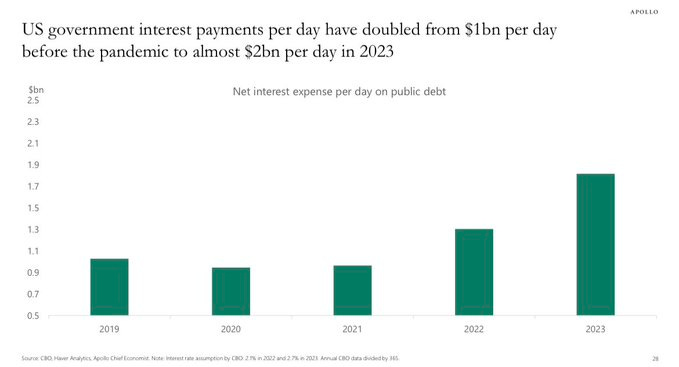

If you look at just the interest payments on our federal debt, it now consumes 40% of all personal income taxes. i.e. almost half of the money you pay Uncle Sam goes towards just the interest the US owes on its old debt.

If we add in new debt (which came in around $2T in 23) that adds up another 80% of your personal income tax.

That's right 120% of your income tax bill is going towards debt.

But wait.... what about the remaining trillions we have to spend for the military, borders, wellfare, healthcare, social security, etc?

Voila. The federal deficit in all its glory.

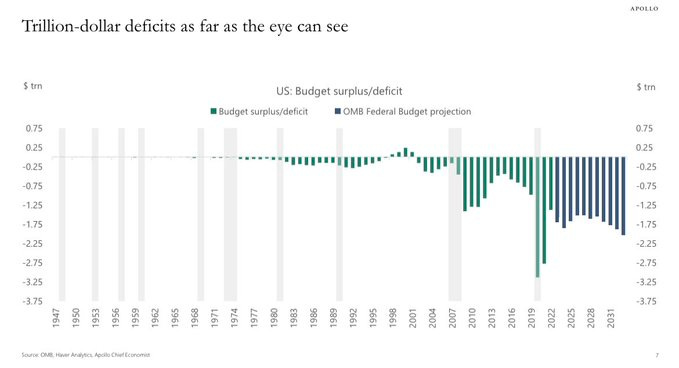

But again, federal deficits are nothing new. The US has almost always spent more than it makes. So what's different now?

A few things: scale, speed, and the extent to which our only solution is also our greatest detriment, i.e. we're being forced to saw off the very branch we stand on.

First, the scale & speed:

Annualized, the Treasury is now predicting a debt expense (i.e. our interest payment) of close to $1 Trillion.

In November 2023 alone, US debt interest was $89B. This is more than we spend for the Departments of... Agriculture, Education, Energy, Transportation, Homeland Security, Justice, State, Transportation, NASA, and Veterans Affairs... combined.

This is just on our old debt. To compound things, new debt is rising at the fastest pace ever. The US Government is currently on track to produce over $6T in debt, annualized. It took the the US 225 years to accumulate $6 trillion in debt. We're now going to produce $6T within 1 year. That's $12 million, every minute, of every day.

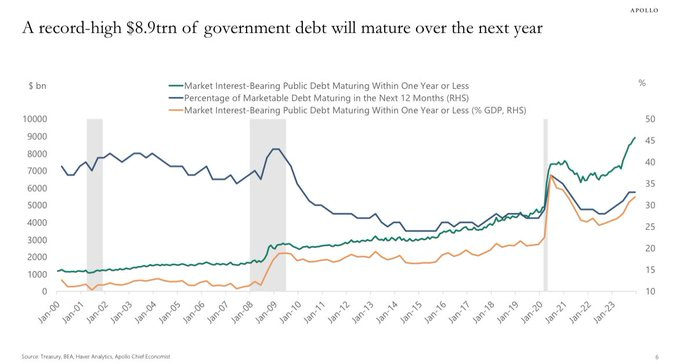

To make things worse, we've made that debt much more expensive by raising interest rates. For the last decade, interest rates were near zero (making the interest payments nominal). Now, they're close to 5%, and a record high $8.9T of govt debt is maturing over the next year. The interest on this debt will have to be repriced at these higher rates… i.e. these interest payments will more than DOUBLE.

As a result, we're forced to take out a new 'credit card' (more debt) just to afford this higher interest payment: the makings of a classic debt spiral (to go deeper on the topic, this tweet by James Lavish is a must read).

Another fun (upsetting) thought experiment: there's about 7k - 10k people retiring every day. We could take the money we’re adding to the national debt, and instead, distribute it to new retirees along with a pat on the back and a nice note saying 'thank you for your contribution, go enjoy your life'.

That check would be $2.5M.

Instead, that money is spent on.. well, who knows what. Retirees see no noticeable benefit from it and that lovely debt burden gets pushed off on to their kids.

*sigh....

Zooming out, the total US debt is now at $34T and on pace to $35T by June.

And we haven't even taken into account future debt from ongoing proxy wars and more inevitable money printing (which is one of the main ways money gets printed: the US issues debt and the Fed + Big Banks buy it, injecting more cash into the system).

Sounds bad, I know. So what are our options?

Cut our committed spending? Nope, its political suicide. No one is going to do it. At least not to the extent that it makes a difference.

Raise taxes? Doesn’t work either. This disincentivizes and disables companies and entrepreneurs ability to increase productivity, conduct R&D, build production lines, hire more people, etc. We'd end up with higher taxes on less productivity/revenue, of which we need as much as possible. Not an option.

Print money & issue more debt? Keep doing what we've always done. Raise the debt ceiling and borrow some more. Stark reality: this is the only option. Listen to 98% of experts, and they'll tell you this outcome is a foregone conclusion, further cemented by the fact that the banking system remains unsound and the US government can't afford a recession (which has been looming for some time now). By printing money they release the pressure valve on banks (with increased liquidity), shore up the markets, and ensure that both tax revenue and GDP don't fall off the cliff.

And here in lies the 'sawing off the branch' metaphor: when they inevitably print more money, they will fan the flames of inflation. This forces the Fed to raise interest rates. But in doing so, three things happen:

1/ they create more instability in the banking system

2/ they increase the cost of our debt (the aforementioned interest expense), and...

3/ they lower tax receipts (as asset prices fall and corporations reduce spending/growth).

A classic tripple whammy that creates an even larger federal deficit than before.

This creates the need for more debt to pay it all off (at higher rates mind you) and further money printing to inflate away its cost.

And... we're back to where we started: more inflation, more interest rate shenangians, more erosion of the banking system, more recessionary risk, more money printing to fix it all. And so the spiral continues...

People might say, "but we'll be fine because our GDP is going up, right?"

Wrong.

A major driver of rising GDP is inflation. Its increasing in dollar terms, not in net new revenue and production, so tax revenues aren't really going up and closing the gap. They actually went down because higher interest rates have crushed assets, and in turn, diminished one of our primary sources of income: capital gains tax.

So as mentioned, the gap only widens.

Another common reaction is to think that the US government knows what its doing. Its full of economic wizards and they must have a master plan.

If that's you, consider the following anecdote from Lyn's book 'Broken Money' (and I'm paraphrasing): during a congressional hearing in early 2021, a congresswoman asked the chairman of the Fed about the implications of the 25% year-over-year spikes in broad money supply due to recent money printing. At the time, inflation was only 1.7%. She asked if it would impact inflation or the value of the dollar.

The chairman dismissed the concerns, saying "that such a surge in the amount of broad money likely wouldn't have important economic implications, and that we may have to 'unlearn' the idea that monetary aggregates have an important impact on the economy."

Fast forward a few months. Inflation starts rising and the Fed chairman initially dismisses it as 'transitory'. And so, they went on expanding the base money supply with 'quantitative easing' (money printing).

Suddenly, inflation is off to the races, hitting its highest rate in four decades.

Our oh so wise leadership at the Federal Reserve panics and does a complete 180. They shift their monetary policy and label inflation as the #1 problem to address, going on to rapidly raise rates and reduce the money supply at a record pace. In doing so, they created more than a trillion dollars worth of unrealized losses for banks holding Treasury securities and other 'low-risk' assets.

Directly from Lyn's book 'Broken Money':

"By sucking deposits out of the banking system at such an aggressive rate, (the Fed) contributed to some of the largest bank failures in American history. By 2023, banks across the country had severely impaired capital ratios due to sharply rising interest rate. For the first time in modern history, even the Federal Reserve itself was running an operating loss due to paying such high interest rates on its liabilities relative to what it was earning on its assets. These Federal Reserve decisions affect the monetary conditions for 330 million Americans and billions of people in foreign countries and yet are made manually and subjectively by a group of just twelve people."

Lyn Alden, one of the most sane, level headed, objective, and pragmatic intellectuals in finance today... goes on to say, "How did we get to this point? Why isn't our money better than this? The global financial system has been broken for developing countries throughout modern history, and in recent decades, it has built up serious imbalances even for developed countries. It's no longer solid at its foundation, in part because its core technology is out of date."

That technology is an entirely flexible, centralized, opaque ledger of money; nothing more than a single node, 1990's database managed on-premises at the Federal Reserve.

The energy/effort required to monetize this debt and expand the money supply? The stroke of a few keys: alt-Control P (Print).

Obviously, the US Government/Federal Reserve isn't going to update their technology any time soon (if ever...)

But we, the people, most certainly can...

Our best option is the antithesis: a ledger/database for money that is 1) inflexible, decentralized, and transparent, 2) has a real-world physical constraint to producing more, and 3) is easy to self-custody, hyper portable, and unseizable.

In the past, the absurdity of our money printing + debt-fueled system was brushed under the rug.

Those who warned about this outcome were labeled conspiracy theorists and boys crying wolf.

Now, even the damn Federal Reserve Chairman (Jerome Powell, our system's primary puppeteer) himself is crying wolf. See this highlight from his interview on 60 Minutes.

He say's (paraphrasing), "The US Government is on a unsustainable fiscal path... and that just means the debt is growing faster than the economy... (over the long run, this concerns me very much), effectively we're borrowing from future generations."

Most recently, Jamie Dimon called it the most predictable crisis in history.

This narrative is rapidly growing in strength, especially on Wall Street. The people in the know are paying close attention and hedging accordingly.

Many are using gold. Some of the smartest, most powerful, and most influential are using digital gold, aka the aforementioned, modernized ledger of money: bitcoin.

Why? Because in a world/market rife with uncertainty and opacity, bitcoin is one of the world's only assets rooted in certainty, transparency, and predictability.

It doesn't matter what interest rates are or what the money supply is. It doesn't matter if there is peace or war; if we have a republican or democrat; if our economy continues to fall folly to human guessing and incompetence (aka central planning).

Regardless of it all... this asset is going to produce a fixed amount (21 million), on a known schedule, and remain entirely auditable along the way.

This is why people like Larry Fink, the CEO of the worlds largest money manager (Blackrock), someone who used to call bitcoin an 'index of money laundering', is now calling bitcoin a 'flight to quality'.

We'll cover how & why bitcoin = quality in a future essay. But first, its important to consider the downstream impact this fucked up game is having on daily life and society at large; beyond just the rising costs, wealth gap, & the Cantillon Effect (discussed in Part I & II)

We'll hit those topics next time in Part IV.

For now, take a breath and relax. Everything is going to be fine. (I think...)

Meanwhile, probably wise to start making that hedge. Buy a little bit of bitcoin and let the power of asymmetry help you sleep better at night.

1% - 5% of your net worth is all the protection you need. An example to illustrate the point:

Compare two portfolios. Portfolio A has 100% exposure to the S&P 500. Portfolio B has 2% BTC exposure, with the remaining sitting 98% in all cash…

Now pick any four year period (since bitcoin’s inception) and look at the compound annual growth rate.

For any one of those periods… Portfolio B would have at least matched the performance of the S&P 500... with only 1/4 the volatility.

Pretty wild…

Key takeaway: allocated appropriately, and along a long term time horizon… bitcoin can create LESS volatility, not more, with massive upside to boot (i.e. the ultimate asymmetric bet: a critical concept to understand if you plan to hold bitcoin).

The challenge is building conviction and lasting through that 4+ year holding period. Fortunately, the beauty of that smidge of exposure? It doubles as a force function to learn… enlivening your curiosity and compelling you to study bitcoin and all its nuance.

Doing this homework is critical. It’s the only way to ignore the perceived volatility and take a long term view. When you do, I promise… the conviction becomes an irresistible, gravitational force.

Hence the famous bitcoin quip, “once you see it, you can’t unsee it”.

If you’re eager to start learning now, this website is the most comprehensive out there: An Encyclopedia of Due Diligence.

With one glance, you’ll see why they say it takes 100+ hours to fully grok bitcoin.

But fret not. In Part V & VI, we’ll compress that journey down to 30 minutes.

Until then… watch this video…

Thanks for reading. If you haven’t read Part I and Part II, check em’ out below. They represent the critical first step towards building said conviction + gravity. Enjoy!

Another super informative writing. Keep ‘em coming!